Guaranteed Whole Life Insurance for seniors provides lifetime coverage with fixed premiums. It ensures a death benefit regardless of age or health.

Guaranteed Whole Life Insurance is an essential financial tool for seniors. This insurance policy offers peace of mind with lifelong coverage and predictable premiums. It ensures that beneficiaries receive a death benefit, which can help cover final expenses and medical bills or leave a legacy.

Seniors often prefer this type of policy because it does not require a medical exam, making it accessible even for those with health issues. By choosing guaranteed whole-life insurance, seniors can protect their loved ones from financial burdens after their passing. This policy serves as a reliable and straightforward option for long-term financial planning.

Table of Contents

Guaranteed Whole Life Insurance For Seniors

The Basics Of Guaranteed Whole Life Insurance

Guaranteed whole-life insurance for seniors provides peace of mind. It ensures that loved ones are protected. Seniors can benefit from knowing their expenses will be covered. This type of insurance offers lifelong coverage. Learn about the basics and key features below.

What is Guaranteed Whole Life Insurance?

Guaranteed whole life insurance is a type of permanent life insurance. It offers coverage for the insured’s entire life. The policy does not expire as long as premiums are paid. This type of insurance is designed for seniors who may have health issues. No medical exam is required to qualify.

Key points include:

- No medical exam required: Coverage is guaranteed, regardless of health.

- Fixed premiums: Premiums remain the same throughout the policyholder’s life.

- Cash value accumulation: The policy builds cash value over time.

- Death benefit: Provides a lump sum payment to beneficiaries upon the insured’s death.

This insurance is ideal for seniors who might be declined for other types of life insurance. It ensures that final expenses, like funeral costs, are covered. It offers financial protection for loved ones.

Key Features Of Guaranteed Whole Life Insurance

Guaranteed whole life insurance has several key features. These features make it a valuable option for seniors. Some of the most important features include:

- Lifelong coverage: The policy remains in force for the insured’s entire life.

- Guaranteed acceptance: Seniors are accepted regardless of their health condition.

- Level premiums: Premiums do not increase over time. This makes budgeting easier.

- Cash value: The policy builds cash value that can be borrowed against.

- Fixed death benefit: Beneficiaries receive a predetermined amount upon the insured’s death.

These features provide financial security. They help in planning for future expenses. Seniors can rest easy knowing their loved ones will be taken care of. The cash value component offers additional benefits. Policyholders can borrow against it if needed. This flexibility adds to the overall value of the policy.

Why Seniors Should Consider Guaranteed Whole Life Insurance

Guaranteed Whole Life Insurance for Seniors offers peace of mind. It ensures that your loved ones are financially protected. This insurance is available regardless of your health condition. Seniors often choose this policy for its guaranteed benefits. Understanding the advantages can help in making an informed decision.

Financial Protection For Loved Ones

Seniors often worry about the financial future of their loved ones. Guaranteed Whole Life Insurance provides a death benefit. This benefit can cover funeral costs, medical bills, and other debts. Your family won’t have to face financial burdens during a difficult time.

Here are some key benefits:

- Covers final expenses: Ensures all funeral and burial costs are paid.

- Pays off debts: Any outstanding loans or credit card debts are covered.

- Leaves a legacy: Provides a financial gift to children or grandchildren.

This type of insurance also builds cash value over time. Policyholders can borrow against this cash value if needed. This feature offers an additional layer of financial security.

No medical exam is required.

Many seniors have health issues that make it hard to get life insurance. Guaranteed Whole Life Insurance does not require a medical exam. This means you can get coverage regardless of your health condition. Your acceptance is guaranteed if you meet the age requirements.

Here are some benefits of no medical exam policies:

- Quick approval process: No waiting for medical exam results.

- Simple application: Only basic information is needed.

- Peace of mind: Knowing you are covered without health checks.

These policies usually have higher premiums. The lack of a medical exam makes them riskier for insurers. Still, the benefits often outweigh the costs for many seniors.

Best Guaranteed Whole Life Insurance For Seniors

Finding the best insurance policy can be challenging. Several companies offer excellent options for seniors. It’s important to compare policies to find the best fit.

Here are some of the top providers:

| Company | Benefits | Premiums |

|---|---|---|

| Company A | No medical exam, quick approval | Moderate |

| Company B | High death benefit, cash value | Higher |

| Company C | Flexible payment options | Low |

Researching different policies is key. Look at the coverage, premiums, and benefits. Choose a policy that meets your needs and budget. This ensures that your loved ones are financially protected.

Understanding The Coverage Options

Guaranteed Whole Life Insurance for Seniors provides peace of mind and financial security. This insurance ensures a guaranteed death benefit and fixed premiums for the policyholder’s entire life. Understanding the coverage options is crucial to making an informed decision. Seniors can benefit greatly from this insurance, which offers stable premiums and guaranteed payouts.

Benefit Payouts

Benefit payouts are a key feature of guaranteed whole-life insurance. The policy guarantees a fixed death benefit that is paid to beneficiaries upon the policyholder’s death. This means your loved ones will receive a lump sum, providing financial support during a difficult time.

Here are some important points about benefit payouts:

- Guaranteed Amount: The death benefit amount is guaranteed and will not decrease.

- Tax-Free: Benefit payouts are generally tax-free for beneficiaries.

- Fixed Payout: The amount is fixed and does not depend on market conditions.

These payouts ensure that your family has the financial resources they need. This can cover funeral expenses, debts, or other financial obligations. The stability of benefit payouts makes this insurance a reliable option for seniors.

Premium Payments

Premium payments are another crucial aspect of guaranteed whole life insurance. The premiums remain fixed for the duration of the policyholder’s life. This means you will pay the same amount every month or year, with no unexpected increases.

Consider the following points about premium payments:

- Fixed Payments: Premiums are fixed and predictable.

- Lifetime Coverage: Payments continue for the lifetime of the policyholder.

- Affordable Options: Many insurers offer flexible payment plans to suit different budgets.

Fixed premiums provide financial predictability and stability. This makes it easier to manage your budget and plan for the future. Knowing that your payments will not increase gives you peace of mind.

Here is a simple table to summarize the key points:

| Feature | Details |

|---|---|

| Fixed Premiums | Premiums remain the same for the policy’s life. |

| Predictable Costs | There were no unexpected increases in premium payments. |

| Lifetime Coverage | Coverage continues as long as premiums are paid. |

Premium payments are an essential part of guaranteed whole-life insurance. They provide the stability and predictability that many seniors need.

Comparing Guaranteed Whole Life Insurance Policies

Guaranteed Whole Life Insurance for Seniors offers a lifelong financial safety net. This type of insurance guarantees coverage as long as premiums are paid. Seniors often consider it due to its simplicity and guarantee of benefits. Comparing these policies helps in choosing the best option for individual needs and budgets.

Coverage Limits

Coverage limits define the maximum amount paid out upon death. These limits vary among policies. It is essential to understand what these limits are and how they impact financial planning.

Most policies offer coverage limits ranging from $5,000 to $25,000. Some insurers provide higher limits, but they come with higher premiums. Here are some common coverage limit ranges:

- $5,000–$10,000: suitable for basic funeral expenses.

- $10,000–$20,000: Covers funerals and some debts.

- $20,000–$25,000: Offers more comprehensive financial support.

Higher coverage limits ensure better financial security. They also allow for settling debts and other expenses. The choice depends on individual financial goals and budget constraints.

Cost Variations

Cost variations in guaranteed whole-life insurance depend on several factors. Age, health, and coverage limits are primary determinants. Older seniors usually face higher premiums. This is because the risk to the insurer is greater.

Health also plays a role. Many guaranteed policies do not require medical exams. But premiums are higher to offset the increased risk. Here is a comparison of average monthly premiums based on age:

| Age | Coverage Amount | Monthly Premium |

|---|---|---|

| 60 | $10,000 | $50 – $70 |

| 70 | $10,000 | $70 – $90 |

| 80 | $10,000 | $90 – $120 |

Choosing the right policy involves balancing coverage needs and budgets. Comparing multiple policies helps in finding the most cost-effective option. It is advisable to seek quotes from different insurers before making a decision.

Factors To Consider Before Purchasing

Guaranteed Whole Life Insurance for seniors is a great option. It offers coverage for the rest of your life. This type of insurance can help cover final expenses. It’s important to consider several factors before purchasing. These factors include age eligibility, policy customization, and the best-guaranteed acceptance of life insurance.

Age Eligibility

Age eligibility is a crucial factor. Most policies are available for seniors aged 50 to 85. Some companies may extend this age range. Be sure to check the specific age requirements of each insurer.

Here are some common age eligibility ranges:

- 50-75 years

- 50-80 years

- 50-85 years

Understanding age eligibility ensures you select the right policy. If you fall outside the age range, the policy might not be available to you. Always verify the age criteria before applying. This helps avoid any potential issues.

Policy Customization

Policy customization allows you to tailor the insurance to your needs. Many insurance providers offer various options. You can choose the coverage amount and payment terms. This flexibility ensures that the policy fits your budget and needs.

Here are some common customization options:

- Coverage amount (e.g., $10,000, $20,000, $50,000)

- Payment terms (e.g., monthly, quarterly, annually)

- Riders for added benefits (e.g., accidental death, critical illness)

Customizing your policy can provide peace of mind. It ensures that the coverage meets your specific requirements. Always discuss customization options with your insurer. This helps you make an informed decision.

Best Guaranteed Acceptance Life Insurance

Guaranteed acceptance life insurance is ideal for seniors with health issues. There are no medical exams or health questions. This makes it easier to get approved. However, it’s important to choose the best policy for your needs.

Here are some top-rated insurers for guaranteed acceptance life insurance:

| Insurer | Age Range | Coverage Amount |

|---|---|---|

| Company A | 50-85 years | $5,000 – $25,000 |

| Company B | 50-80 years | $10,000 – $50,000 |

| Company C | 50-75 years | $3,000 – $20,000 |

Choosing the best-guaranteed acceptance life insurance ensures you get the coverage you need. Compare different insurers and their offerings. This helps you find the best policy for your situation.

Tips For Finding The Best Policy

Guaranteed whole life insurance can be a great option for seniors. This type of insurance provides lifelong coverage. It also offers a cash value component. Finding the best policy can be tricky. Several tips can help you make the right choice. Doing proper research and seeking advice is key.

Researching Insurance Providers

Start by researching different insurance providers. Look for companies with good reputations. Check online reviews and ratings. A high rating can mean a trustworthy provider. You can also visit the provider’s website. Look for detailed information on their policies. This can help you understand what they offer. Comparing different providers can also be beneficial. Here are some key points to consider:

- Financial stability of the provider

- Customer service quality

- Policy options are available

- Premium costs

Another way to gather information is by talking to friends and family. They might have recommendations. Personal experiences can provide valuable insights. You can also contact the provider directly. Ask specific questions about their policies. This can give you a better understanding of your options. Researching thoroughly will help you make an informed decision.

Consulting With Financial Advisors

Consulting a financial advisor can be very helpful. Advisors have expertise in insurance and finances. They can guide you through the process. A good advisor will assess your needs and goals. They can help you choose the best policy. Financial advisors can also explain complex terms. This makes it easier to understand what you are buying.

Here are some questions to ask your financial advisor:

- What are the benefits of whole life insurance?

- How much coverage do I need?

- What are the costs involved?

- Are there any additional fees?

Choosing the right advisor is important. Look for someone with good credentials. Check their certifications and experience. You can also ask for references. A trustworthy advisor will have positive reviews. Consulting with an advisor can give you peace of mind. They can help ensure that you make the best decision for your future.

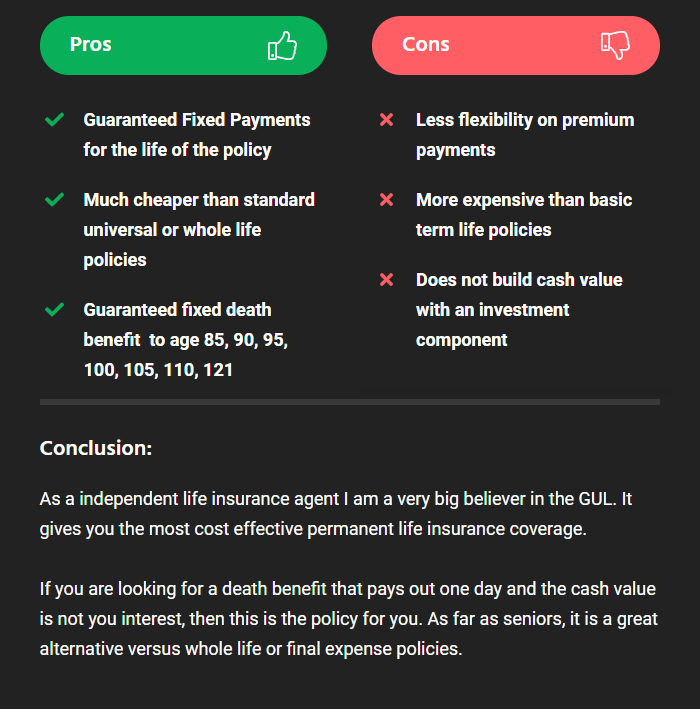

Common Misconceptions About Guaranteed Whole Life Insurance

Guaranteed Whole Life Insurance is a popular choice for many seniors. It offers permanent coverage and a guaranteed death benefit. There are several misconceptions about this insurance type. This blog post aims to clarify some of these common misunderstandings.

Limited Coverage Options

Many believe that guaranteed whole-life insurance has limited coverage options. This is not true. Several policies offer flexible coverage amounts. Here are some key points:

- Coverage amounts can range from $5,000 to $50,000.

- Policies can be tailored to meet individual needs.

- Additional riders can be added for extra benefits.

Some policies also provide cash value accumulation. This means that a portion of your premium goes into a savings account. Over time, this amount grows. You can borrow against it or use it for emergencies.

In summary, the idea of limited coverage options is a myth. Seniors have several choices to fit their unique needs.

High Premiums

Another misconception is that guaranteed whole-life insurance has high premiums. While it might seem expensive, the cost depends on several factors. Here are a few:

| Factor | Impact on Premium |

|---|---|

| Age | Older seniors may pay more. |

| Health | Healthier individuals may get lower rates. |

| Coverage Amount | Higher amounts lead to higher premiums. |

Despite these factors, there are ways to find affordable policies. Comparing different providers can help. Also, some companies offer discounts for non-smokers or those in good health.

In essence, while premiums may vary, they are not always high. Seniors can find policies that fit their budget and needs.

Conclusion And Final Thoughts

Guaranteed Whole Life Insurance for Seniors is a crucial financial tool that provides lifelong coverage and peace of mind. This type of insurance ensures that seniors can leave a legacy for their loved ones and cover final expenses without burdening their families. The policy’s guaranteed nature means that coverage remains in force as long as premiums are paid, offering a sense of security and stability. This blog post explores the significance of ensuring financial security and making informed decisions when considering whole-life insurance for seniors.

Ensuring Financial Security

Financial security is a top concern for seniors. Guaranteed whole life insurance plays a vital role in achieving this goal. This insurance offers lifelong coverage, ensuring that policyholders are protected for their entire lives. The key benefits include:

- Guaranteed Death Benefit: The policy guarantees a death benefit payout to beneficiaries, providing financial support when it is most needed.

- Fixed Premiums: Premiums remain the same throughout the life of the policy, making it easier to budget and plan financially.

- Cash Value Accumulation: Over time, the policy builds cash value that can be accessed for emergencies or other needs.

Additionally, whole life insurance can cover final expenses such as funeral costs, medical bills, and outstanding debts. This ensures that loved ones are not left with a financial burden during a difficult time. The policy also allows seniors to leave a legacy, contributing to their family’s future financial stability.

In summary, guaranteed whole-life insurance offers consistent coverage, financial peace of mind, and a way to secure a lasting legacy for seniors and their families.

Making Informed Decisions

Choosing the right whole life insurance policy requires careful consideration. Seniors must evaluate several factors to ensure they make informed decisions. These factors include:

- Policy Features: Examine the death benefit, cash value accumulation, and premium structure of different policies.

- Financial Strength of the Insurer: Select a reputable insurance company with a strong financial rating to ensure reliability.

- Cost vs. Benefits: Compare the costs of premiums with the benefits offered to determine the best value.

Consulting with a financial advisor can provide valuable insights and help seniors understand their options. Advisors can offer personalized recommendations based on individual needs and financial goals. It is also essential to read the policy documents carefully to understand all terms and conditions fully.

By taking the time to research and seek professional advice, seniors can make well-informed decisions. This ensures they select a policy that meets their needs and provides long-term financial security.

Conclusion

Choosing guaranteed whole-life insurance for seniors ensures lifelong coverage and financial peace of mind. It’s a smart investment for seniors seeking stability. Protect your family’s future with a reliable insurance plan. Make an informed decision today for a secure tomorrow.